Industry Observation: When “Sports Flooring” Becomes a Professional Terminology

Google’s global buyer purchasing behavior analysis shows that the average monthly search volume for “basketball court wood flooring” has increased by 47% over the past three years, while the search fluctuations for “basketball court wood flooring prices” precisely reflect the budget cycles of school fiscal years in North America and Europe. This data reveals a clear trend: professional basketball wood flooring has moved from being an exclusive feature of large sports stadiums to a standardized requirement for schools and community sports centers. For foreign trade practitioners, understanding this quietly occurring material revolution is key to securing orders.

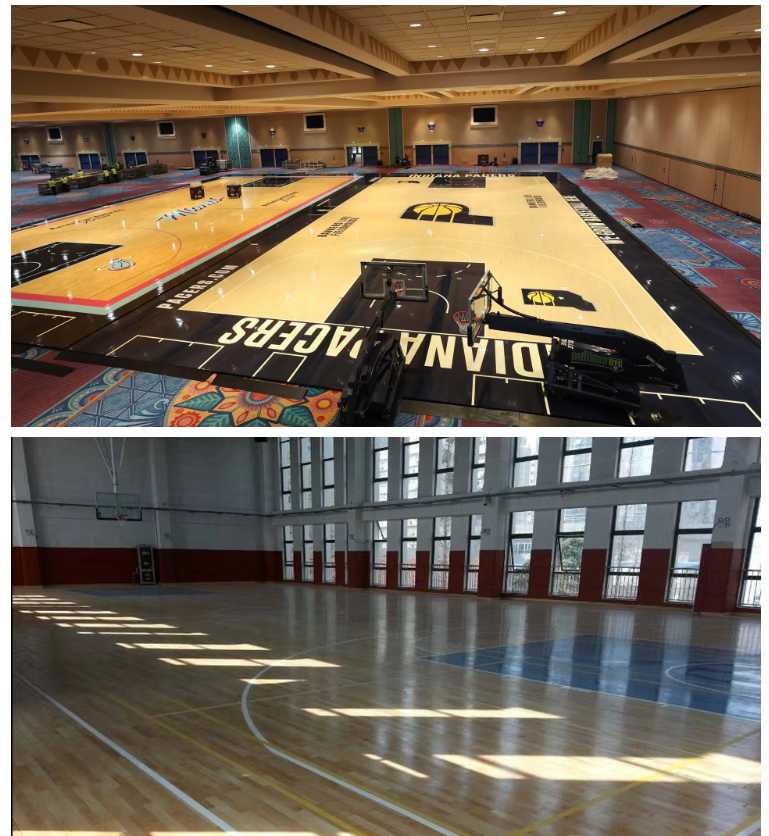

Indoor Basketball Court Wooden Floor for School and Club Installation

Technical Core: How Installation Processes Define Product Value

Behind the professional term “wooden floor laminating” lies a technological race concerning sports performance and lifespan. Traditional solid maple flooring uses a click-lock floating installation, while modern high-performance systems often employ a multi-layered composite structure—a top layer of 3-5mm North American hard maple or oak sports surface, a middle layer of cross-laid pine or spruce load-bearing, and a bottom layer of moisture-proof balancing. This “sandwich structure” physically offsets the internal stress of the wood, allowing the flooring to remain stable even in areas with significant humidity fluctuations.

“Now, inquiries for high-end projects explicitly request cross-sectional diagrams of the flooring’s laminate structure and DIN-certified shock absorption rate data,” noted the foreign trade manager of a sports flooring manufacturer in Shenzhen. “Buyers no longer just ask what ‘wooden floor laminating’ is, but specifically, ‘How does your double-layer resilient underlayment system achieve a 53% shock absorption rate?’ This indicates that market education is complete, and we’ve entered a stage of professional procurement.”

Factory Direct Basketball Court Wood Floor for Stadium Projects

Price Restructuring: From Material Costs to Lifecycle Value

Analyzing the global distribution of “basketball court wood flooring prices” reveals a clear value stratification. The Southeast Asian market remains highly focused on the FOB price per square meter, while buyers in mature European and American markets generally adopt a “lifecycle cost” calculation model—they are more concerned with maintenance costs, renovation cycles, and resilience within 15 years of initial installation.

A compelling example is that in a 2023 tender, a Nordic municipality ultimately selected a Chinese supplier whose price was 23% higher. Their technical evaluation report showed that the deciding factor was the flooring system’s ability to be renovated five times, with each renovation costing only 18% of the original price, resulting in a lower total cost of ownership over 30 years compared to lower-priced competitors. This signifies a shift from price competition to value competition.

Professional Basketball Court Wooden Flooring System for Sports Halls

Signals of Supply Chain Geography Restructuring

New characteristics are emerging in international trade flows. Previously, North American hard maple had to be shipped to Asian factories for processing before being sold to Europe; now, a new model of “European prefabrication + local installation” has emerged. Chinese manufacturers complete the pretreatment and finishing of the substrate for multi-layer composite flooring in their Chinese factories, while the top sports surface layer is separated into untreated boards and transported to European warehouses along with the resilient system. Finally, it is locally cut and installed on-site according to project orders. This model saves 15% on logistics costs and shortens delivery cycles by 30%.

“This requires our foreign trade team to upgrade from ‘product experts’ to ‘solution architects’,” the foreign trade manager added. “We need to provide at least two supply chain solutions during the quotation stage: traditional turnkey shipping and emerging modular local assembly solutions, clearly explaining the differences in tariffs, logistics, and after-sales service for each solution.”

Environmental certification becomes an invisible entry barrier

2024 will be a watershed year for environmental certification of sports flooring. The EU’s upcoming Ecodesign Regulation and the update to California Proposition 65 are forcing manufacturers to innovate their materials. Water-based UV-cured coatings, FSC-certified wood, and recyclable resilient underlayment have gone from selling points to basic requirements.

Forward-thinking manufacturers have already begun to plan for next-generation materials. Laboratory data shows that a new material composed of bamboo fiber and high-performance resin has approached the levels of maple in two key indicators: vertical deformation rate and ball rebound rate, while its growth cycle is only 1/20th that of hardwood. Although large-scale commercialization is still 2-3 years away, this suggests that the definition of “basketball court wood flooring” may transcend the category of solid wood in the future.

For the sports industry, this market is shifting from a red ocean of transparent pricing to a new arena built on technical standards, environmental certifications, and supply chain efficiency. Suppliers who can clearly explain the scientific principles of lamination processes, provide full life-cycle cost analysis, and flexibly configure global supply chains will reap the dual rewards of pricing power and customer loyalty in this new round of industry reshuffling.

For more product information, please click here for details.

Publisher:

Post time: Jan-30-2026